To date, there is no consensus among the biggest ESG data providers on how to score the companies’ ESG performance. Clearly, different ESG scores create confusion. What should a regular retail investor make of it?

Developments in financial reporting over the years has led to some degree of consensus. In a perfect world, we would like to say the same about ESG scores. Unfortunately, this is not the case at all. With so many different ESG scoring methodologies on the market, there can be a wide spread of different views on the same company.

The correlation of ESG rating agencies is generally quite weak – 0.40 (comparing to the correlation of credit ratings which is at a strong 0.90 mark). To illustrate this problem, we can turn to a widely-cited research by Berg, Kölbel and Rigobon, as featured in the Financial Times:

Companies with some of the biggest discreppancies in ESG ratings. Median ratings from 5 rating agencies. Source: FT.com and MIT School of Management.

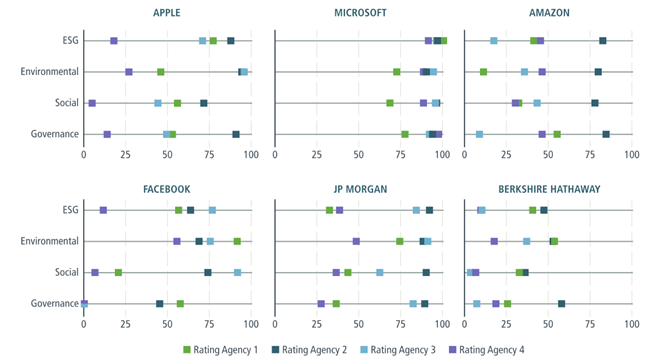

An investigation by Legg Mason provides another telling illustration:

Divergence in ESG ratings across large global companies. Source: Legg Mason Asset Management Australia, MSCI, Sustainalytics, Refinitiv, Robeco.

What is the main reason for difference in ESG ratings?

To put it simply, subjectivity. Assessing sustainability invites more than a fair dose of subjective judgement. For example, should Adidas be evaluated the same way Facebook is? In theory, unified scoring would bring transparency and simplicity, right? – Perhaps, but the two companies are very different. To scratch the surface, issues surrounding data privacy would be less relevant for Adidas, while Facebook doesn’t need factories or workshops that risk polluting the environment. So how do you compare say, data privacy and environmental impact?

The first step is often determining what factors are material to the company the agency is looking at.

Not all ESG issues matter equally. In accounting, something is deemed to be material if its omission would have an impact on financial outcomes. In a similar vein, ESG indicators are material if they affect characteristics of a company. For example, companies that protect employee health and safety are generally at lower risk of litigation and work stoppages which impact their ability to produce profits. A practical insight on how the data providers work can shed more light on the process.

Sustainalytics, one of the biggest ESG rating agencies, has mapped 138 “sub-industry” groups with specific scoring for each factor within each sector. For example, mining companies may be more vulnerable to the physical effects of climate change than the tech sector, so those risks are weighted more heavily in the miners’ ratings. Sustainalytics reviews its ratings manually to incorporate the new risks as they pop up.

Sustainalytics as well as other rating agencies, big and small, use a combination of data-driven processes driven by the analysts judgement. What’s more, the particularities of methods used in ESG evaluation are a carefully guarded secret. Ultimately and despite of the keen efforts by the ESG data agencies, we see how subjective judgement and lack of transparency in the domain leads to scattered ratings:

– Scope divergence. For example, some rating agencies would consider governmental lobbying as a detrimental factor in good governance practices, while others don’t.

– Weight divergence. Is environmental performance more important than social initiatives? How about the governance practices?

– Measurement divergence. Happens due to different ways to evaluate the same factor.

Is subjectivity the only bias in ESG ratings?

Unfortunately not, but this is a slightly different discussion. There are certain biases that may to an extent affect some or all ESG ratings. Well-known biases are related to company size and geography:

– ESG ratings tend to favour large multi-national companies. Many companies have started producing large ESG reports, detailing their sustainability policies. Such efforts are expensive. As a result, large companies have more resources to achieve the data transparency sought by data providers.

– European companies often score higher on ESG ranges. This is largely due to advanced levels of ESG reporting standardization in Europe. We can expect this discrepancy to be eliminated in time.

How will the situation change in the future?

A surge of ESG-alligned investing is a growing trend, so can we expect more alignment of ESG criteria in future? To an extent, yes. Here are a few pointers on how exactly.

ESG data is evolving. Organisations such as the Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) have encouraged company level transparency and continue to help drive a framework towards increased standardisation.

The industry insiders claim that ESG ratings will never achieve the kind of homogeneity of credit ratings, or similar financial scores (due to the factors discussed above). But at the end, this may be an advantage: a spectrum of opinions can be more helpful to an observant investor. On top of this, uniformity of ESG scores my serve as yet another systemic factor influencing companies, industries and economies in a disruptive way, so better “careful what you wish for”.

On a much more optimistic note, the European investor can expect a considerable increase in quality of ESG data available, due to the new EU regulations in March 2021. The landmark EU rules regulate ESG data disclosure, so investors will get better tools to cut through the greenwashing noise.

The virtuous ESG-statements now have to be backed up by evidence of real sustainability efforts. And some asset managers may realize that they overstretched their claims on how sustainable they are. More on this in one of our upcoming materials.

Great, so what can we take out of this?

The reputable ESG rating agencies put remarkable effort in their work and can generally be trusted. For starters, one may stick to one or several rating agencies with a solid track record. As soon as any of the ESG scores drops below an acceptable level – that’s a reason for a deeper dive into the issue.

And of course, as the good old saying goes, retail investors interested in sustainable data should educate themselves on the vast amount of data available or to seek a professional investment advice. Do not half heart your money.